Samsung Offers Unique Proposal to Fulfill NVIDIA's Demands for HBM3 Memory and Packaging

Samsung is positioning itself to provide NVIDIA with HBM3 memory and packaging services for their AI GPUs. With the semiconductor giant TSMC struggling to meet NVIDIA's growing demand, NVIDIA is exploring a dual-sourcing strategy to stabilize its supply chain.

TSMC currently manufactures the majority of NVIDIA's wafers and supplies advanced 2.5D semiconductor packaging. However, the substantial workload associated with the 2.5D CoWoS packaging for HBM3 chips, which are presently supplied by SK Hynix, has led NVIDIA to consider alternative suppliers. Among the potential candidates are U.S.-based Amkor Technology and Siliconware Precision Industries Taiwan (SPIL), as reported by DigiTimes.

Samsung has also entered the race through its AVP (Advanced Package) division, proposing a unique solution for NVIDIA's needs. The company has offered to source semiconductor wafers from TSMC and HBM3 from its memory division. Using its unique I-Cube 2.5D packaging, Samsung is potentially providing NVIDIA with a single supplier responsible for all development stages. Furthermore, Samsung has pledged to assign several engineers to this project and has even suggested directly acquiring the semiconductor wafer from the foundry division in the future.

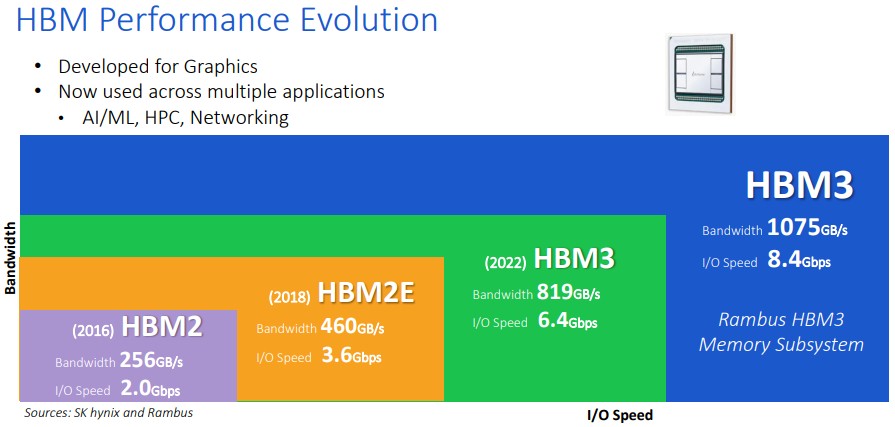

Samsung's HBM3 memory, already in mass production, promises faster speeds (at 6.4 GB/s) and significantly reduced energy consumption compared to SK Hynix. These benefits have already attracted AMD, which uses Samsung's HBM3 in its latest MI300 Instinct APUs. If the NVIDIA deal proceeds, Samsung could reportedly acquire a total order volume of 10%.

The critical deciding factor will be whether the quality of Samsung's HBM3 and 2.5D packaging meets NVIDIA's standards. Samsung and TSMC are essentially in a race to develop facilities to serve their partners rapidly. If Samsung manages to win NVIDIA's trust, TSMC could find its market share threatened. However, the deal's complexities could potentially harm the NVIDIA-TSMC relationship, which would not be beneficial for either company.

A recent report indicating that Samsung is leading TSMC in yield rates and fabrication technology adds intrigue to the situation. The outcome of this race could have significant implications for the future of the semiconductor industry.