Bitcoin Surpasses $30,000 Mark Ahead of Upcoming Halving

Bitcoin continues its impressive surge, now trading above the $30,000 mark, marking a significant milestone as the cryptocurrency approaches the upcoming halving. This noteworthy development raises expectations of a new bullish rally for Bitcoin, in line with past cycles.

Adding fuel to this surge, various factors are aligning in favor of Bitcoin. On the macroeconomic front, the low initial unemployment claims for September and Federal Reserve Chairman Jerome Powell's statements about extending a pause on interest rate hikes have contributed to Bitcoin's bullish momentum. Bitcoin is often likened to a growth-focused tech stock due to its strong correlation with indices like the Nasdaq. This is because Bitcoin's value is influenced by its scarcity and expectations of future price increases, similar to how the present value of future cash flows is determined using a discount rate derived from the Fed's benchmark interest rate.

In terms of intrinsic factors, Coinbase has expressed optimism about the potential launch of spot Bitcoin ETFs in the United States. A spot Bitcoin ETF would provide a convenient way for investors to gain exposure to Bitcoin without the drawbacks associated with futures-based ETFs. According to K33 Research, the launch of spot Bitcoin ETFs could attract approximately 100,000 BTC in new investments within months, equivalent to around $3 billion at current prices.

Additionally, Grayscale has filed a registration statement with the SEC to convert its Bitcoin Trust into a spot ETF, signaling confidence in a favorable outcome for this initiative. Meanwhile, the SEC appears to be revising its stance on cryptocurrencies, as evidenced by its decision to drop its lawsuit against Ripple. The court's non-binding judgment in the Ripple case clarified regulatory uncertainties surrounding Bitcoin and other major cryptocurrencies.

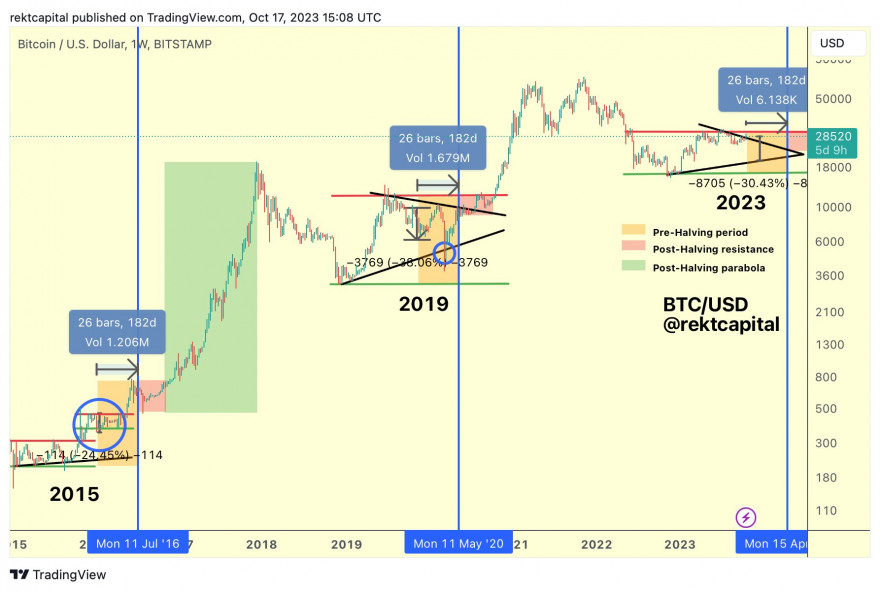

While Bitcoin's recent strength is a positive development for investors, it's important to note that historical data suggests the cryptocurrency may experience corrections of 25-38% at any given time.